AMIS GPD Development, Jacob & Co to tap into Dubai’s luxury property boom

How to Maximize Returns with the Best Investment Properties in Dubai

Dubai’s property market is a story of constant evolution: new neighborhoods, changing demand, shifting regulations. At AMIS Development, we’ve watched it closely. We help investors like you spot the sweet spots—the properties that don’t just look good on paper, but deliver real returns. If you want to find the best investment properties in Dubai, this is your guide. Understanding What Drives Strong Returns Before you pick a property, you need to know what makes it profitable. There are several factors; missing any one of them can erode returns fast. All this matters when you’re looking for the best investment properties in Dubai—you want a property that ticks many boxes, not just one. Where to Look: Hotspots That Deliver We at AMIS have seen certain Dubai neighborhoods consistently deliver strong returns. These areas combine healthy rental yields, steady demand, ongoing infrastructure growth—and in many cases, a lower entry cost for investors. Here are a few worth considering: AMIS Development Projects You Can Trust Since we want to show what “investment‐grade” means, here are a few of our own projects that illustrate best practices when you invest in the best investment properties in Dubai. These are examples of how we at AMIS Development aim to deliver the best investment properties in Dubai, combining location, design, trust, and predictable cash flows. Tactics to Maximize Returns Having the right property is just one part. How you structure your investment makes a big difference. Common Mistakes to Avoid When Investing We see investors trip up on a few recurring issues. We don’t want that for you. Maximizing returns with the best investment properties in Dubai means more than finding beautiful buildings. It’s about matching location, developer quality, payment plan, demand, and smart choices. At AMIS Development, our philosophy is to make those choices easy—to offer projects with real appeal, clear value, and strong return potential. If you’re considering investing, whether in one of our Meydan projects or elsewhere, do your homework: check yields, check costs, check ownership terms. Do what feels secure. And if you’d like, we can walk you through AMIS projects, compare expected rental yields, show you samples, and help build a strategy to get the most out of your investment. Because when done right, investing in Dubai real estate can reward you for years to come.

AMIS Development gets first tranche of Dh5b funding from Singapore’s First APAC Fund

How To Invest In Luxury Dubai Properties As A First-Time International Buyer

Buying a luxury property in Dubai for the first time feels a bit like stepping into the city’s glittering skyline — full of excitement, but also a little overwhelming if you don’t know where to begin. At AMIS Development, we’ve worked with many first-time buyers and sBuying a luxury property in Dubai for the first time feels a bit like stepping into the city’s glittering skyline — full of excitement, but also a little overwhelming if you don’t know where to begin. At AMIS Development, we’ve worked with many first-time buyers and seen how the right approach can turn an initial purchase into a long-term asset that keeps growing in value. Dubai’s property scene is unlike any other. It is so fast, so dynamic, and full of possibilities that it is very attractive for international investors. But just a wish will never get one far in this market: you need a laid-out plan for it. Why Dubai Is Still Drawing International Buyers Dubai isn’t just an International city: it is a brand of itself. No property taxes, strong rental yields, a lifestyle second to none in the world… This is what attracts the big spenders from all over the world. Add safety, world-class infrastructure, and a business-friendly environment to the mix. Luxury in Dubai is about more than just a big home. It might be a penthouse with sweeping marina views, a villa tucked into a quiet golf community, or a beachfront home with private sand. Over the years, we’ve seen our clients at AMIS Development choose Dubai not just for a property, but for the lifestyle and long-term potential itrepresents. Step 1: Define Your “Why” Before You Buy Before entering listings, identify what you want from your purchase. Do you want to use it as your personal home, vacation home, or rental property? Your answer will shape every decision — from the neighborhood to the payment plan. For instance, someone chasing rental income might be drawn to Downtown Dubai, with its tourist appeal and proximity to major attractions. Someone else seeking privacy and space might lean toward Emirates Hills. When you’re clear on your goal, every choice becomes easier — and smarter — when you invest in luxury Dubai properties. Step 2: Get to Know Dubai’s Property Rules for Foreign Buyers Dubai has one of the most open real estate markets for international investors. Foreigners can buy freehold property in specific zones, giving them complete ownership — with the ability to sell, lease, or pass the property on. Some basics to know: At AMIS Development, we walk our clients through these details so they never feel caught off guard Step 3: Match the Location to Your Lifestyle (or Your Tenants’) Luxurious enclaves in Dubai have their personalities: Choosing isn’t just about price. It’s about finding a property that fits the life you want — or the lifestyle your tenants will pay a premium for. We often recommend exploring a few neighborhoods in person before deciding. Step 4: Explore Your Financing Choices Cash buyers can move quickly, but mortgages are common for international buyers too. You can usually borrow 50%–75% of the property value, with terms depending on your income and residency. Sometimes, developer payment plans offer more flexibility than banks. We help clients compare all options so they end up with a financial setup that supports — rather than limits — their goals when they invest in luxury Dubai properties. Step 5: Plan for ROI and an Exit Strategy Luxury real estate doesn’t mean locking away your money forever. Many buyers enjoy steady rental income or resell for a profit within a few years. In prime areas, yields can be especially appealing. We encourage our clients to decide their exit plan early — whether that’s selling in two years, five years, or holding the property for long-term gains. A clear strategy keeps you focused on the bigger picture. Step 6: Budget Beyond the Purchase Price Owning property in Dubai comes with extra costs. Include these in your budget: If you roof well, you will avoid leaks later. Step 7: Seal the Deal After you have decided upon the property, here are some of the common steps: We are with our clients, from the first tour to the final key handover, ensuring that every step feels smooth and stress-free. Step 8: Think Beyond Purchase The hottest entry-level buyers in Dubai understand selling as part of larger wealth-formation strategy. Considering the fast forward growth of Dubai, your investment today might stand good increase in value along with lifestyle in years to come. Wrapping Up Your 1st luxury home in Dubai is not just an address; it’s a portal to one of the fastest real estate markets in the world. Adequately planned and supported well, it can be a dream home as well as an investment. At AMIS Development, we combine market insight with a hands-on approach to help you invest in luxury Dubai properties with confidence. From your first viewing to the door of your property, we want to make sure the entire journey is worth your while. If you are ready to take this step and see what luxury real estate in Dubai has to offer, then we are ready to lead you through it.

AMIS Development shapes the next era of living

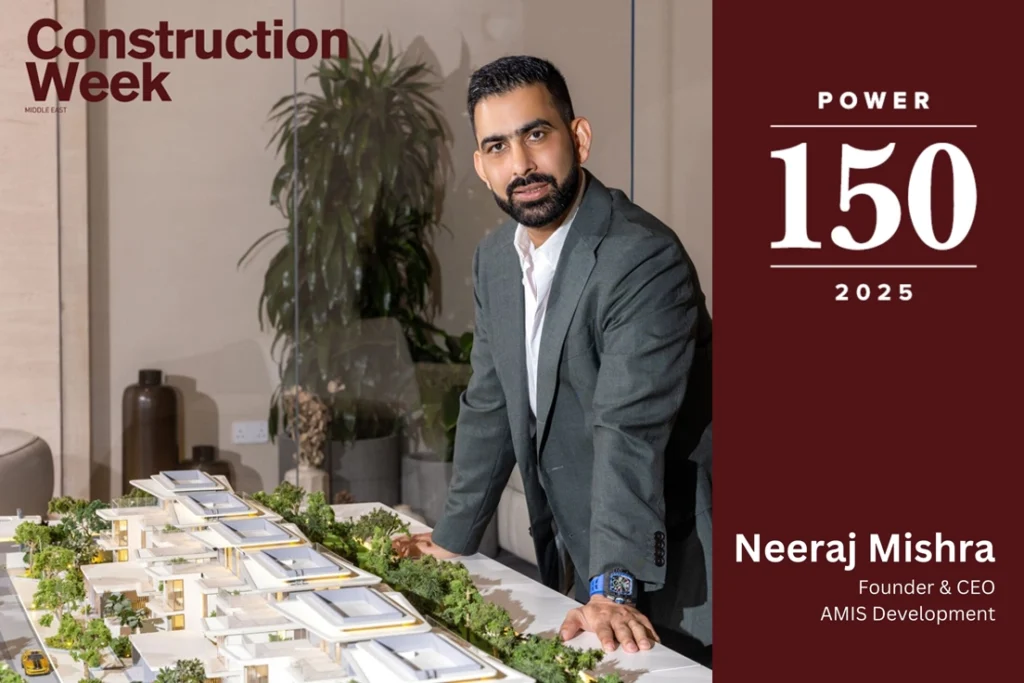

AMIS Development Founder & CEO, Neeraj Kumar Mishra has been named one of the Top 150 Real Estate Icons of the UAE by Finance World.

AMIS Development CEO Neeraj Kumar Mishra Named Among Middle East’s Most Influential Leaders in Construction Week Power 150

Luxury real estate driving Dubai’s global brand

The Dubai-Miami-Singapore triangle: Which city wins the battle for the richest property buyers?

The growing demand for ‘Work-Life-Play’ spaces in Dubai’s urban landscape